While personal health insurance often falls short of total coverage, your HSA or FSA card provided by your employer can offer full coverage for your care. How? Insurance companies may claim to cover chiropractic care, but they often impose limits and subject claims to strict administrative review to protect their own profits and minimize costs. This can result in reduced coverage for services like chiropractic care. With an HSA or FSA, however, you’re in control, using your funds without the hassle of restrictions or approvals, ensuring your care is fully covered.

If you have an HSA card with a Visa or Mastercard logo in your wallet, it works just like a debit card—but it’s specifically for healthcare expenses. While you can’t use it everywhere, you can use it to cover your chiropractic care costs. Chiropractic offices, including ours, accept HSA cards without issue, and we’ve never encountered any problems processing them.

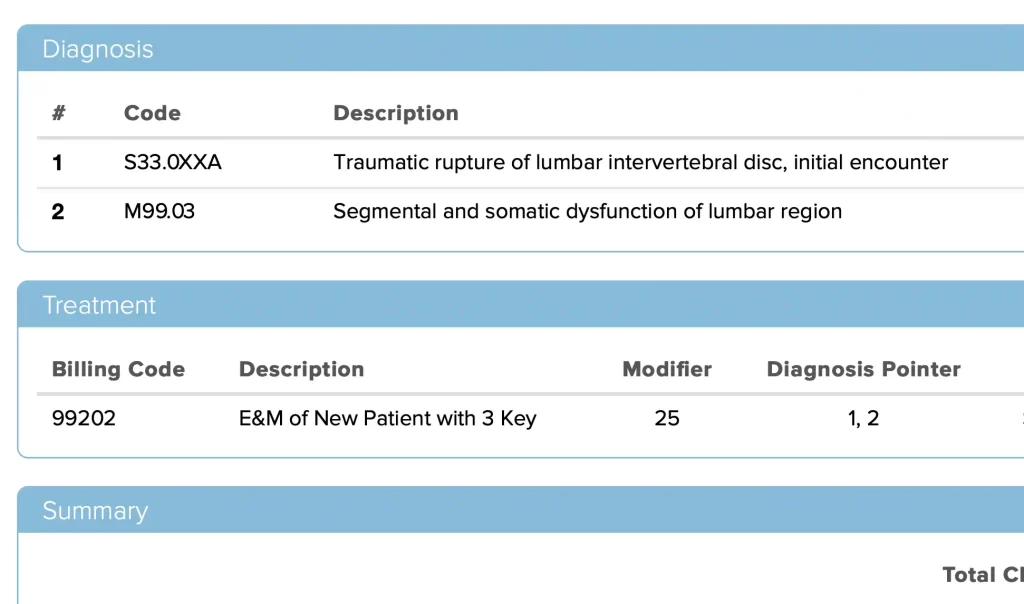

Sometimes, your HSA provider may require a detailed receipt, or “superbill,” to verify that your chiropractic visit was a legitimate, covered service. All services provided in our office are HSA-eligible. Upon request, we can provide a superbill that includes procedure and diagnostic codes for every visit, ensuring everything matches what you’ve been charged.

A Health Savings Account (HSA) is a type of “consumer-directed healthcare plan.” These plans were created to give you, the healthcare consumer, more control over your healthcare decisions, reducing the influence of insurance companies. The goal is to help you take a more active role in managing your own health.

Want to choose chiropractic care instead of relying on pain medication? With an HSA, you can direct your own care. You know what’s best for your health—better than any insurance company.

The Patient Protection and Affordable Care Act (PPACA), commonly known as Obamacare, helped expand the use of HSAs. Consumer-directed plans, like HSAs, are part of Obamacare and often serve to cover the gap in high-deductible insurance plans.

• Health Savings Accounts (HSA): These accounts allow you to make tax-free payments for healthcare expenses, giving you the freedom to decide how to spend your healthcare dollars. Funds are held by a provider who pays your chiropractor when you use your HSA card. Best of all, these funds roll over year after year. Note: you need a high-deductible insurance plan to open an HSA.

• Flexible Spending Accounts (FSA): FSAs work similarly to HSAs but do not require a high-deductible insurance plan. They can also be used for non-healthcare-related expenses. We accept FSA cards for chiropractic care, just like a debit card. However, FSA funds are owned by the employer, not the employee, and they don’t roll over from year to year. So, if it’s nearing the end of the year, it’s time to schedule that chiropractic visit!

• Medicare Medical Savings Account (MSA): MSAs are designed for Medicare recipients, offering a consumer-directed option that can help offset costs not covered by Medicare, like exams or treatments beyond adjustments. In chiropractic care, Medicare only covers adjustments, so an MSA can help with additional expenses.

• Health Reimbursement Arrangement (HRA): This is an employer-sponsored account where employees can manage their healthcare funds. These accounts often roll over year-to-year, making them a great option for saving on healthcare costs without needing an expensive, high-coverage insurance plan.

• Voluntary Employee Benefit Associations (VEBA): VEBAs are set up by groups of employees who organize to negotiate rates for their healthcare plan. While less common, they can offer unique benefits to those involved.

• Multiple Employer Welfare Arrangements (MEWA): MEWAs are health benefit plans created by two or more unrelated employers or self-employed individuals. These plans are designed to provide small employers access to low-cost health coverage, similar to what larger employers offer.

Health savings accounts allow you to make your own healthcare decisions, free from the constraints of insurance companies. With an HSA, you can access chiropractic care directly, avoiding the need to pre-qualify services with your insurer. This creates a more streamlined, cost-effective transaction, benefiting both you and our office by minimizing administrative costs tied to insurance processing.

You might be wondering if we take your HSA or FSA cards as payment for chiropractic care (in Petaluma.) The answer is...

Service Type: Chiropractor, HSA cards, FSA cards